Your mobile recharge either prepaid or postpaid is just a click away with erechargebyte! Trusted by over 27 million users, erechargebyte is your one-stop shop solution for online recharge. erechargebyte covers major network providers in India, that include Airtel, Aircel, Vodafone, BSNL, Idea, Tata Docomo (GSM), Uninor, etc. Not only that, to facilitate the online recharges, the latest talk time plans and data packs are updated on the erechargebyte website accordingly. This makes the data more reliable, and the interface becomes more user-friendly for users.

We at erechargebyte not only provide you easy accessibility, we also ensure quick transactions. It is possible to complete a prepaid mobile recharge with us in less than 10 seconds. You can do an instant mobile recharge and Win a chance to receive coupons and rewards on a successful transaction.

We provide online/Offline DTH recharge service provider. Our DTH service covers the service providers like Tata Sky, Dish TV, Sun Direct, Videocon D2H and Big TV.You can recharge it at the comfort of your home or office Gprs Based Recharge or simple wright sms based Recharge or online recharge with few clicks of mouse. All you need to have is a computer with internet connection and online recharge of your prepaid DTH account is just few clicks away.

This Portal provide is a leading pre-paid mobile recharge website in INDIA- On B2B Retailers and users can recharge prepaid mobile online.and provide makes for a very convenient way to recharge all DTH in INDIA. There are a lot of DTH operators in India who provide superior services to their customers.

Single Wallet providing recharge facility to all DTH Service Provider.

Upload your Wallet as and when required, no need to maintain a minimum balance.

Our DTH Recharge facility provides direct connection to all Operators for DTH Top-up.

Provision of flexible Top-up services through a variety of device options at the Retail level - Web and App.

You can get various kinds of DTH Recharge bundles. We offer the DTH Recharge solutions offered in the current day. We make your DTH Recharge options valuable, in addition to extremely economical and at the same time making no compromises on efficacy. We put all efforts for introducing the latest technological trends which makes our DTH Recharge solutions above level. Our DTH Recharge solutions offer you basically two types of DTH Recharge choices; one is termed as Basic DTH Recharge solutions and the other is the Company DTH Recharge solutions.

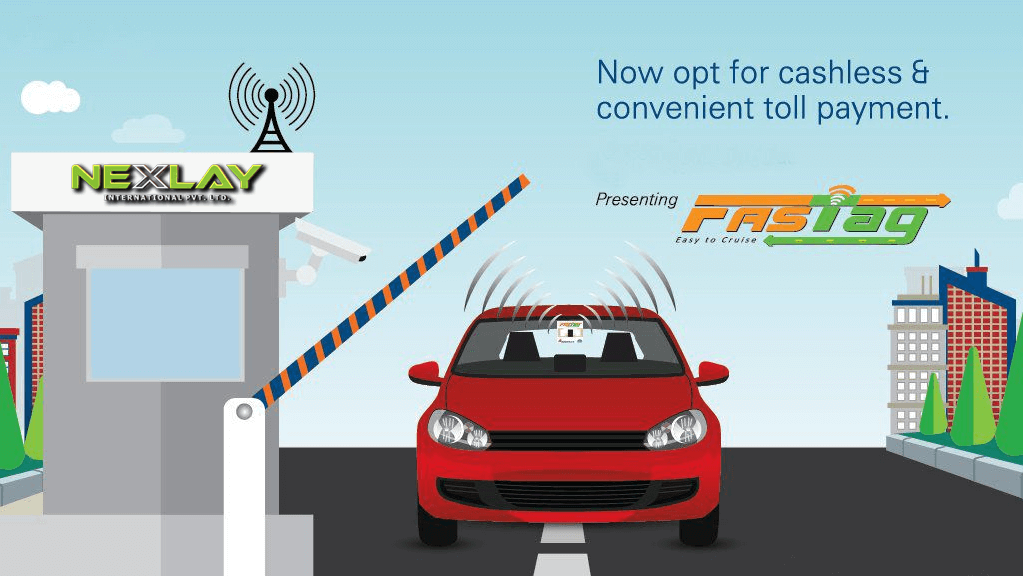

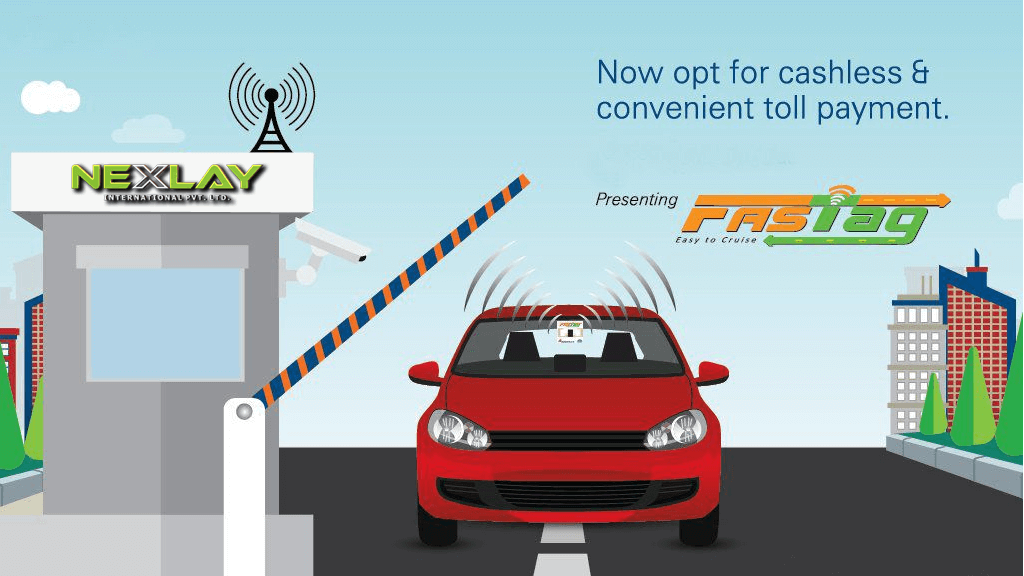

FASTag is a device that employs Radio Frequency Identification (RFID) technology for making toll payments directly from the Prepaid Account linked to it. It is affixed on the windscreen of your vehicle and enables you to drive through toll plazas, without stopping for cash transactions. National Electronic Toll Collection (NETC) programme uses FASTag device that employs RFID technology.

for making electronic toll payment. The FASTag is mounted on the vehicle’s windscreen. As the vehicle reaches the toll plaza, the unique identification number that is embedded on the tag is read by the RFID reader. Applicable toll amount as per the vehicle category is deducted from the Prepaid Account that is linked to the FASTag. You may recharge your FASTag Account by making payment through cheque or online through Credit Card/Debit Card/NEFT/RTGS/UPI or Internet Banking. NETC FASTag is RFID passive tag used for making toll payments directly from the customer linked prepaid or saving/current account. It is affixed on the windscreen of the vehicle & enables drive through toll plazas, without stopping for any toll payments . ...

Soon enough, the market saw a new player emerge in the market. With the introduction of Netflix in the market, the scene was changed entirely for Over-The-Top (OTT) media, or popularly known as Internet Streaming, and the landscape changed completely. Soon enough, many new players joined in, like Amazon Prime, Hulu, Voot, and, more recently, Apple TV (yet to be launched).

In recent years, getting famous in India, online streaming apps and websites are taking over the television industry by storm. More and more people prefer these services over Television because it has better content, exclusive shows, movies, and faster premiers. So, with so many streaming services in the country, it comes down to selecting the best ones. India now faces a host of options when it comes to OTT services. However, the most dominant ones are still Netflix and Amazon Prime. Regional online streaming sites do well and have a huge number of users. Despite that, beating Netflix and Amazon Prime can be a bit difficult. The original

erechargebyte has raised people's expectations for everyday comforts. But paying your postpaid mobile bill every month can also be a hard task at times, especially when you are running short of time, or have urgent meetings. You might even have to pay a late fee due to a missed deadline and now that you know, you simply cannot pay it as the bill payment office is closed. So what is the solution? Online recharge comes as a big relief!

FreeCharge facilitates postpaid mobile bill payment for an array of major companies including Airtel, Vodafone, Tata Docomo, Idea, and BSNL. Faster: Even when you realise that you have only five more minutes to pay your postpaid mobile bill, simply resist the urge to panic and utilise FreeCharge’s services to pay your bill quickly. Payment through FreeCharge is

The most competitive providers are state-owned BSNL, Tata Indicom, Airtel and Reliance. Before taking a subscription with a telephone company, it is worth shopping around and comparing international calling tariffs. It generally takes between two and five days after contacting a company for a connection to be set up. New customers can visit the chosen company’s nearest office or arrange for a representative to visit their home with the required application forms and to collect the documents needed.

To call a landline number in the same city, dial the seven- or eight-digit number (without the area code). To call a mobile number in the same state, dial the ten-digit number. To call a landline number in another city, dial the standard trunk dialling (STD) code for the relevant city before the number. For example, to call a number in Nagpur, it would be necessary to dial “0712” before the landline number.

Public telephones and phone booths can be found almost everywhere in India. They are usually run by local grocers or shopkeepers. Public telephones are usually yellow or red and are operated by inserting an Rs1 coin. A phone booth run by a shopkeeper is called a public call office (PCO). They allow users to make national and international calls. The handsets are linked to a meter that records the length and cost of a call.

erechargebyte is an Internet Service Provider busy in offering Internet and similar value added services to its customers. You can easily stay connected with your loved one through special data limit plans available at erechargebyte. Now you can easily take benefit from the superfast Internet from any location or any time! erechargebyte is an Internet Service Provider busy in offering Internet and similar value added services to its customers. You can easily stay connected with your loved one through special data limit plans available at erechargebyte. Now you can easily take benefit from the superfast Internet from any location or any time!

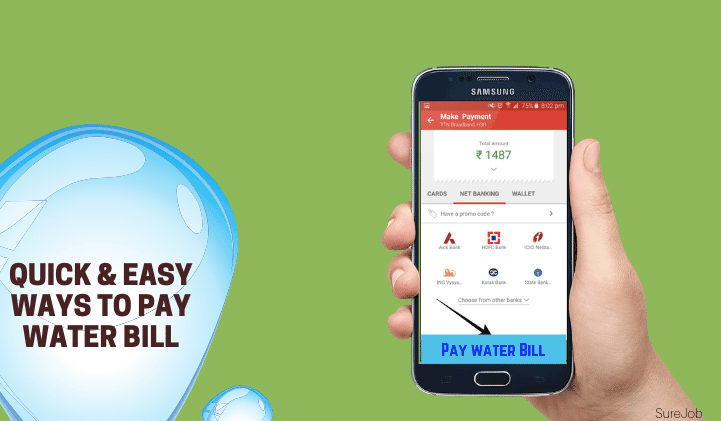

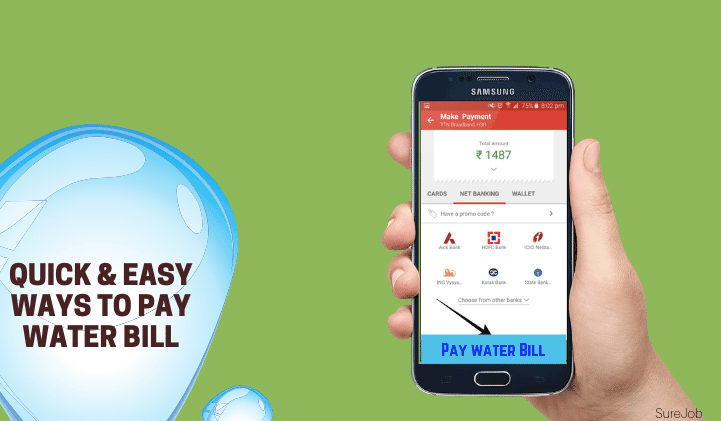

Electricity is one of the basic requirements in our life. It is essential for all households and also large scale industries. Everyone use electricity for all-purpose, like home electric appliances or heavy machines in companies etc. In Mini ATM no more waiting for long queues for the bill payment of Electricity. Paying power bill in online is the more useful. In online you can pay anytime & anywhere without moving due date. Pay your Power bill from laptop, desktop, mobile and tablet.

Some people missing their last date of electricity bill that leads to extra payment of late charges. Mini ATM offers a suitable platform for everyone to pay electricity bill payments & avoid that late fee, just pay your electricity bill online in fraction of seconds.

We offer electricity bill payment API for third-party integrations, where you could integrate your website with your retailers. Our API services are secure with related payment gateway and there are no hidden charges for the energy bill. We have a well trained and experienced staff for creating a web application and mobile application. We provide customized service to our clients as per their requirement. We're adding an Increasing Number of support to our APIs such as Mobile Recharge API, Travel Booking API, (Flight Booking API, Bus Ticket Booking API, Hotel Booking API), and Money Transport API.

Online gas booking can be instantly and easily made using the Cyrus Recharge app or webpage . Cyrus Recharge allows its users to make LPG booking online and get the LPG gas booking no in not more than 5 steps. Cyrus Recharge also offers huge offers for LPG gas bookings and enable the users to make their gas bill payment online without any hassle. Making online gas booking through Cyrus Recharge is an easy and instant process and offers great savings. Thus, Cyrus Recharge is the best platform for online gas payment.

LPG or Liquefied Petroleum Gas is the most widely used cooking gas. A safe and environmentally friendly equivalent to wood or kerosene, LPG is now readily available through a comprehensive distributor network. The government of India also subsidizes the cost of a fixed number of cylinders every year, making it affordable for households to use LPG for their fuel needs. Booking an LPG gas cylinder used to be a long and tedious process earlier, since the only way to do so was by visiting the LPG dealership in person. This was followed by an anxious wait as a cylinder would be dispatched based on its availability, with LPG cylinders going missing or not reaching the recipient on many occasions. All these woes are a thing of the past now, with the three national LPG suppliers - Bharat Gas, HP Gas and Indane Gas, making their services more consumer-friendly and transparent.

Insurers are in cross-road to deal with key challenges like new entrants disrupting the business model pressurizing to adopt newer technologies, complex IT landscape impeding the release of new products to market. Lesser productivity due to redundant processes, increasing operational costs, fraudulent practices and regulatory changes are the other major hurdles for these organizations. erechargebyte, a leading global IT solution partner has proven expertise to tackle these challenges, with its strong technology and engineering capabilities along with business and domain knowledge.

Our global insurance practice blends an unrivalled depth and breadth of Insurance Industry knowledge with a rich set of core capabilities in Business Consultancy, claims management , insurance claims management, Integration and Applications Management.

All Insurance Services, LLC of Indiana offers practically every type of insurance for yourself, your family, and your property. We represent many of the best-known and highly-rated insurance companies in the country. Some of our most important areas of coverage include:

“Water. It’s the invisible thread that weaves together our daily lives. We often take it for granted and we easily forget that there is simply no substitute for water. Although Americans consume a lot of water, few people realize what is required to treat and deliver water every day or how wastewater is cleaned so that it can be safely reused or returned to the environment. The typical American household uses 260 gallons of water every day, making our nation’s water footprint among the largest of any country in the world. The quality of life we have become accustomed to is largely dependent on an adequate and consistent supply of safe water.

Water service provides the foundation for the health and safety of our families and the economic prosperity of our communities. It truly does touch everything we care about. Private water companies are dedicated stewards of this precious resource and are committed to ensuring the water service they provide is both safe and reliable.”

FASTag is a device that employs Radio Frequency Identification (RFID) technology for making toll payments directly from the Prepaid Account linked to it. It is affixed on the windscreen of your vehicle and enables you to drive through toll plazas, without stopping for cash transactions. National Electronic Toll Collection (NETC) programme uses FASTag device that employs RFID technology, for making electronic toll payment. The FASTag is mounted on the vehicle’s windscreen. As the vehicle reaches the toll plaza, the unique identification number that is embedded on the tag is read by the RFID reader. Applicable toll amount as per the vehicle category is deducted from the Prepaid Account that is linked to the FASTag.

You may recharge your FASTag Account by making payment through cheque or online through Credit Card/Debit Card/NEFT/RTGS/UPI or Internet Banking.

FASTag is linked to a prepaid accounts where the applicable toll amount is deducted. The label employs Radio-frequency Identification (RFID) technologies and is affixed on the car's windscreen after the label account is active. “Toll Plaza" is your building or facility where the User Entry is accumulated. It is an "ETC Program" of the government of India. So cars don't need to wait in a queue.

With us, your loan EMI payment online can be really convenient. Yes, we, erechargebyte – the leading digital wallet and provider of online payment services in India – have tied up with a number of companies such as Bajaj Finserv and so many others of its ilk to bring to you a portal that you can use to pay your estimated monthly installments (EMIs). We can help make any and every personal loan EMI payment easier for you. You can do it from just about any device that you please.

If you are a tech savvy person and own a Smartphone or tablet phone then you can make the payment from that device itself. In case you have a laptop with a killer internet connection then you can use that as well. Even if it is just a rudimentary desktop that you have then you should not worry as we will help you pay from that as well.

We have assisted a lot of people in making their loan EMI payment online. When you try and make the payment from our interface you would see to your utter delight that we have made it very easy and simple for you. You would now be able to make the payments quite easily in just a few steps.

erechargebyte has partnered with some of the biggest brands in cable TV and internet to provide you with the best service options in your area. Enter your zip to see which Internet Service Providers (ISPs) and TV providers are available in your area, then compare cable companies, telecommunication companies, and satellite providers side by side. After you find a provider that meets your needs, visit the provider link to view specific packages and promotions for each provider in your area.

erechargebyte lets you find cable providers by zip code and compare them with satellite and fiber providers for both TV and internet service. You'll find customer ratings, channel lineups, notable features, and other information to help you choose the best service provider for your household.

Booking an cylinder in India is no longer a tedious task that requires you to visit the gas agency or make a call to the agency. It can be conveniently done from the comfort of your home using WhatsApp, SMS, website or app. If you are wondering how to book Gas cylinder using these methods, you’re not alone. Gas customers can simply visit the official website of the provider to book their gas cylinders. The Gas online booking portal has listed all methods by which customers can book their cylinders from their home. We have listed the step-by-step guide of all methods in one concise article. So without any further ado, let’s take a look.

This is the time-tested method, where a customer visits the gas agency outlet and places the order. The official Gas website has a listing of all distributors in each state and Union Territory in India. After looking for their nearest dealer, customers can visit the same to book their cylinder. The dealer will ask for consumer number, name and address to record the booking and will provide a booking number for future reference.

Now you don’t have to wait in long queues or excuse yourself from work to deposit school or college fees through a Cheque, Demand Draft, Challan or Cash. This can be done on your Mobile Phone or Laptop using the Paytm App/ Web in the comfort of your own home or office in a matter of a few minutes! You can pay large fee amounts safely using Paytm Net Banking (NB), Debit Card (DC), Credit Card (CC), Paytm Wallet or UPI.

Paytm has forged partnerships with several schools, colleges, universities and other premium academic institutions across India such as IIT Delhi, IIT Roorkee, IIT Madras, Manipal University, Amity University, Thapar University, Delhi Public School, CMR National Public School, LPU, Galgotias University, Apeejay Group, Resonance, Allen Institute, Aakash, Made Easy, Career Launcher to name a few.

Subscription Fee means the amount the Customer is required to pay for the Subscription to the Product/Service, which may be billed monthly or annually. The Customer is required topay the Subscription Fee in advance and Inogic and/or a licensed third-party reseller shall charge the Customer at one time for a Subscription. Prices for each Order is fixed at the time the Subscription is first placed and apply throughout the Term.

Subscription Fees shall be payable through an online payment gateway maintained by Inogic through credit or debit cards or other modes of payment made available by Inogic. Subscription Fees may be subject to change without notice and any such revised Subscription Fees shall apply only at the time of placing a new Order or an Order for renewal of an existing Subscription. Orders once made and Subscription once received are final and unalterable and Subscription Fees, once paid, shall be non-refundable. Subscription Fee means a fee, of up to 3 per cent of the aggregate investment amount subscribed. This fee is payable to the Investment Manager. This fee may in turn be paid in full or in part by the Investment Manager to introducing agents, intermediaries or sub-distributors. The Subscription Fee is charged at the absolute discretion of the Investment Manager and may be waived or reduced, in whole or in part, at the discretion of the Investment Manager.

Municipal taxes are taxes paid to the local municipality on properties owned by you. There is no uniform rate for municipal taxes, as different municipalities have different rates. Municipal taxes are also known as property taxes, house taxes, and municipality taxes. Municipal taxes in detail

Let's take an example of Municipal Corporation of Greater Mumbai. In Mumbai, municipal taxes are determined by a range of factors, some of these are listed below. Municipal ward or locality Whether the property is self-occupied or it is occupied by tenants Year of construction Number of floors Type of construction Carpet area

Forms of property tax vary across jurisdictions. Real property is often taxed based on its class. Classification is the grouping of properties based on similar use. Properties in different classes are taxed at different rates. Examples of property classes are residential, commercial, industrial and vacant real property.[2] In Israel, for example, property tax rates are double for vacant apartments versus occupied apartments.[3] France has a tax on vacant properties, which successfully reduced the vacancy rate.[4]

Hospital is deeply committed to the highest standards of excellence in medical care. At the same time we place a lot of importance on the traditional values of hospitality and compassionate patient care. Our primary concern is to ensure that your health and comfort receives special attention and that you are given the best possible care once you enter the portals of our hospital. We give you here a few details about our hospital so that your experience at our hospital is comfortable and pleasant. The hospital is equipped to serve Continental and Intercontinental cuisine customized for the patients to suite their palate. This makes our patients feel comfortable & facilitates a speedy recovery.

In India, hospitals provide different types of wards for patients. Some of these are; general wards, private wards, semi private wards etc. Depending on choice and costs, patients can opt for any type of ward. Modern hospitals are sufficiently equipped to provide huge comfort to patients and are no less, or sometimes better than homes.

Historically, clubs occurred in all ancient states of which we have detailed knowledge. Once people started living together in larger groups, there was need for people with a common interest to be able to associate despite having no ties of kinship. Organizations of the sort have existed for many years, as evidenced by Ancient Greek clubs and associations (collegia) in Ancient Rome.

The other sort of club meets occasionally or periodically and often has no clubhouse, but exists primarily for some specific object. Such are the many purely athletic, sports and pastimes clubs, the Alpine, chess, yacht and motor clubs. Also there are literary clubs (see writing circle and book club), musical and art clubs, publishing clubs. The name of “club” has been annexed by a large group of associations which fall between the club proper and friendly societies, of a purely periodic and temporary nature, such as slate, goose and Christmas clubs, which do not need to be registered under the Friendly Societies Act.

Well, the facilities are owned by the housing society committee, or in another way, it can be said that the facilities are shared the property of all the owners of the units within the society. And the housing society committee, run by the members elected among and by the members of the society, is responsible for the maintenance and management of the facilities.

Generally, the charges for the are included in the monthly maintenance bills and is divided among all the units equally. Also, some facilities say like personal usage of community hall (for ceremonies and parties) can be chargeable and to be paid by the particular member. In some places, even usage of the gymnasium and swimming pool can come with a subscription charge.

Therefore, if we have to define ‘Facility management’ for a housing society, it can be said, maintaining the usability condition of the facilities, managing the usage timing of the facilities and to take care of any dispute arising with regards to the facilities is what is called facility management.

erechargebyte is one of the top business correspondents in India. It has developed a Domestic Money Transfer platform to help the daily wage workers, laborers, and the under-banked sections of the society. These people are facing problems in cash deposits and accessing money transfer services. This DMT platform is easy and convenient to use. Now you can transfer money to any bank account immediately. You don’t need to wait or stand in the long queues and fill out the form to deposit cash. Instead of accessing smartphones and the internet, this product enables end customers to deposit funds through our technology-driven agents. Our agents are available during non-banking hours, holidays, and even on festive occasions. Domestic Money Transfer is a cash transfer administration that offers the office to transfer cash to any individual or a business that might be on the opposite side of the globe immediately.

Aadhaar Enabled Payment system is a bank-led model created by the National Payments Corporation of India (NPCI) that allows the customers to use Aadhaar as an identity to do the financial transactions which work at the POS (Point of Sale) through UIDAI or Aadhaar authentication of the customer. Aadhaar Enables Payment System (AEPS) provides facilities like government schemes and the handicapped old age pension. With the help of business, correspondent customers can carry out all transactions. The AEPS software works on the POS (point of sale) which is easy to use, interoperable across various banks and payment method is safe and secure. It encourages and serves the underbanked sections of society.

Aeps service provider bank allows the customers to withdraw money only using Aadhaar ATM. There is no need to visiting a bank or ATM. There is no need for the debit card only with the verification of the Aadhaar number and fingerprint impression is required and anyone can transfer money immediately to their family and friend’s bank account.

Financial Inclusion and Micro Banking have become very prominent buzzwords in the Indian banking marketplace. Indian banks have BCs (Banking Correspondents) visiting customer houses and providing banking services at-home for quite some time. So far these people have been using a bulky expensive device with limited features. Importantly, Indian Government’s Adhaar initiative which provides a base ID to each Indian, has become the baseline reference for providing these services. erechargebyte has modified its mPOS product to add functions associated with an ATM (Cash Withdrawal and Cash Deposit) to create a product called mATM. mATM enables banks to appoint merchants and other individuals as BCs at a fraction of the cost and also enable them to provide bank-agnostic ATM services.

You may recharge your FASTag Account by making payment through cheque or online through Credit Card/Debit Card/NEFT/RTGS/UPI or Internet Banking.

For this the system supports Adhar Enabled Payments System (AEPS) through integration of a STQC certified biometric device. The system has been tested for a seamless integration with the UIDAI/AADHAAR infrastructure.

mPOS systems are portable hardware devices which work wirelessly and process payments through a range of payment methods – Credit Cards, Debit Cards, Chip-based cards etc. With mobile wallets and NFC technology gaining popularity, many of the mPOS hardware allow payments through these as well. These are much more cost effective than PSTN (public switched telephone network) or Desktop GPRS POS systems, which have high installation & maintainance costs. Additionally, most of the available mPOS systems are suitable for all sizes of business. Since the hardware unit comes equipped with a SIM slot, merchants in remote areas can also process payments through GPRS, in the absence of a fixed line network.

IMPS stands for Immediate Payment Service (IMP). It is an internet banking payment system that instantly transfers funds among partner banks electronically in the country. The service can be accessible 24/7 is offered even on bank holidays, unlike other options. Funds are electronically transmitted amid member banking institutions via mobiles. In India, National Payment Corporation of India (NPCI) manages IMPS, which has designed based on the prevalent National Financial Switch network. Funds can be transmitted and received through the system of IMPS utilizing a Mobile Money Identifier and authorized mobile numbers.

Don’t worry about your due dates for Credit Card bill payment as you can pay your credit card bills from anywhere and anytime on Paytm. Paytm allows you to make credit card bill payment for the Visa, Master, American Express (Amex), and Diners credit card of all the major bank. Be it SBI, HDFC, IndusInd Bank, Citi Bank and many other. So just #PaytmKaro and pay your credit card bill instantly on Paytm and leave all the stress behind. Paytm’s credit card bill payment service is very easy and just takes a few steps to get processed. Moreover, you get many different payment options for your Credit Card payment.

Payment gateways are used for making payment transactions via an electronically communicated channel. It is a front end technology that reads the banking information the user and communicates that information to the merchant banks at both ends in electronic signals. A payment gateway is an elementary step towards making payment via digitally communicated payment transaction channels. A payment gateway reads the banking information of the person making a payment transaction. Further, it transmits the information to the merchant banker acquiring the payment.

Payment gateways are a blend of software and servers that create a platform where transaction information to acquiring banks and responses from issuing banks taken are exchanged in for of electronic signals.

Google Play services is used to update Google apps and apps from Google Play. This component provides core functionality like authentication to your Google services, synchronised contacts, access to all the latest user privacy settings and higher quality, lower-powered location based services. We give you here a few details about our hospital so that your experience at our hospital is comfortable and pleasant. Google Play services also enhances your app experience. It speeds up offline searches, provides more immersive maps and improves gaming experiences.

Google Play services Android to help you build your app, enhance privacy and security, engage users, and grow your business. These SDKs are unique in that they only require a thin client library to be included in your app, as shown in figure 1. At runtime, the client library communicates with the bulk of the SDK's implementation and footprint in Google Play services.

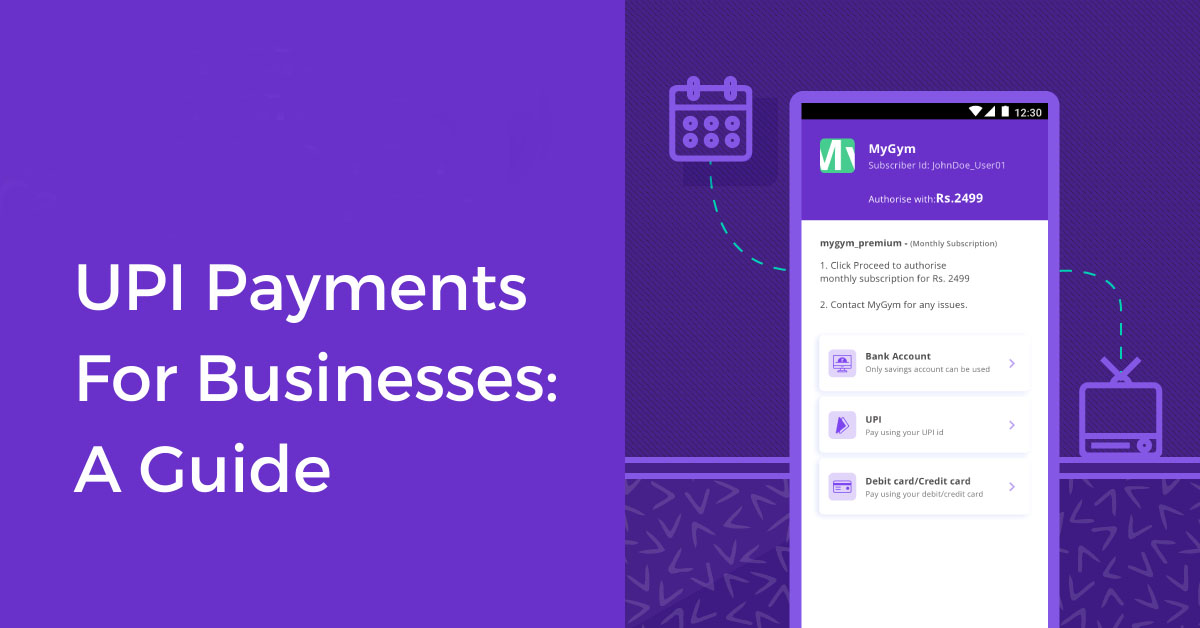

You can take the help of UPI ecollection API services to transfer money from the merchant account to the account of the customers. You can use this money as refunds, cash backs, reimbursements, etc. UPI has become a very popular method of money transfer in recent times. It also saves you a lot of trouble and makes it easier for you to deal with your cash. The UPI ecollection API services will also allow businesses to provide a faster checkout experience to the users. You will also be able to view what is going on in your account instantly.

You can take the help of UPI ecollection API services to transfer money from the merchant account to the account of the customers. You can use this money as refunds, cash backs, reimbursements, etc. UPI has become a very popular method of money transfer in recent times. It also saves you a lot of trouble and makes it easier for you to deal with your cash. The UPI ecollection API services will also allow businesses to provide a faster checkout experience to the users. You will also be able to view what is going on in your account instantly.

With UPI becoming a popular mode of payment, it makes sense for businesses to offer UPI as a payment option to their customers. You should go for a UPI payment gateway i.e. a payment gateway that supports UPI as a payment option along with credit card, debit card, net banking, wallets etc. Here, are lists of top benefits UPI offers you and also how your customers benefit by paying you via UPI. Since we are talking about UPI payment gateway, let’s include one of the leading payment gateways of India, PayUmoney, as an example.

No App Needed: To accept payments from your customers in your bank account, there is no need to download, sign up or create an account in any app. Only your customers need the UPI app to pay you. All you need is a payment gateway which enables accepting UPI payments.

Scan & Pay: Pay by scanning the QR code through Scan & Pay or generate your to let others make easy payments to you. Transactions: Check your transaction history and also pending UPI collect requests (if any) You can raise complaint for the declined transactions by clicking on report issue in transactions. Bharat Interface for Money (BHIM) is an app that lets you make simple, easy and quick payment transactions using Unified Payments Interface (UPI). You can make instant bank-to-bank payments and Pay and collect money using just Mobile number or Virtual Payment Address (UPI ID).

Permanent Account Number abbreviated as PAN is a unique 10-digit alphanumeric number which is issued to taxpayers by the Income Tax Department. You can apply for the number through NSDL or UTIITSL. The application can be made either online or offline. Here, we take a look at how you can track the status of your application on the NSDL and UTIITSL websites as well as through a phone call and SMS. The process of checking the status by providing your name and date of birth, coupon number, etc. is also provided. Read on to know more.The NSDL webite can be used to check PAN status by choosing the application type, entering acknowledge number. It can also be tracked on the UTI website using an application coupon number or PAN number.

Today, you need a PAN card for many financial transactions like opening a savings bank account, Fixed deposit, applying for a new credit card, investing for mutual funds and so on. These things can't be done without a PAN card. If you are joining a new company, even your employer asks you to submit the PAN card. So, it is very important to have a PAN card.

No App Needed: To accept payments from your customers in your bank account, there is no need to download, sign up or create an account in any app. Only your customers need the UPI app to pay you. All you need is a payment gateway which enables accepting UPI payments.

We leave no stone unturned to ensure a comfortable life for our loved ones. Health is one aspect of our lives that has become a priority today. The outbreak of the contagious disease, COVID 19, has brought focus on how unpredictable life can be. The world is facing an extraordinary situation amidst the pandemic. Thus, it calls for extraordinary efforts to safeguard the health of your family. A family health insurance policy offers you a financial safety net against unexpected medical expenditures.

One of the noteworthy features of health policy is the cashless treatment facility offered at network hospitals. You can avail of the best medical care without the need to pay medical bills from your pocket. There are over 15500+ cashless healthcare provider across India, where you can get the best medical treatment using your health card

We only use high quality printers and processes. Your gift vouchers and boxes will always reflect the quality of your brand and business. The Gift industry is dominated by 3rd parties and technology companies controlling your online revenues. We saw an opportunity to offer Hotels and Restaurants something completely different; YOUR OWN MONEY… Our vouchers are issued with unique voucher ID’s and QR codes to increase the security of your vouchers and make redemptions really simple on mobile devices and iPads when you have no access to a PC.

Income Tax Returns or ITR is a form used to declare the net tax liability, claiming of tax deductions, and to report the gross taxable income. It is mandatory for individuals who earn a certain amount of money have to File IT Returns. Firms or companies, Hindu Undivided Families (HUFs), and self-employed or salaried individuals must file ITR to the Income Tax Department of India. You can file the ITR by visiting the official website of the Income Tax Department. However, the registration process must be completed before you can file the IT Return online. The Income Tax Department (ITD) of the Government of India has recently updated the online portal for e-filing of income tax returns. The updated portal makes the e-filing process even easier and can be filed by following the steps mentioned below:

For every GSTIN registered, a taxpayer is mandated to file a return against it. This return is called as GST return. In fact, there are 22 types of GST returns prescribed under the GST Rules? Out of them, only 11 are active, 3 suspended, and 8 view-only in nature.

The GST law has prescribed the following number of returns. And these returns are prescribed with the due date of filing with its provisions laid in CGST Act 2017

Since the government has mandated return filing under GST, thus you must file a NIL return even if there is no transaction. However, you must keep in mind:

You cannot file a return if you do not file the previous month/quarter’s return

Hence, late filing of GST return will have a cascading effect leading to heavy fines and penalty

The late filing fee of the GSTR-1 is populated in the liability ledger of GSTR-3B filed immediately after such delay.

The Goods and Services Tax was set in motion from 1st July, 2017. This bill prohibited the cascading effect of the previous taxation system and promotes the notion of the ‘one nation, one tax’ system. For individuals who reside outside India but supply their goods to the residents of India, this GST Registration must be opted by them. This type of registration is similar to ‘Casual Taxable Person’, where the individual taxpayers are expected to pay a deposit of money that is equivalent to liable GST at the time of active GST registration. This type of registration is valid for 3 months, but it can be further extended or renewed as per the requirement.

It is important for businesses to understand when they are expected to complete their online GST registration. According to the rules set by this act, it is mandatory for an individual to register under GST if he/she has a business with a turnover of approximately 40 lakhs and above. GST Registration can be done using the GST new registration online portal, and it takes about 6 working days to complete the registration process.

Bus booking can be quite a hassle if you physically had to go to the state transport office or the local bus depot to make buy your tickets. The long queues and the risk of high exposure in times of the pandemic forces one to make an online bus booking instead. Enter Yatra where purchasing bus tickets is easy as a pie. Yatra’s vast repository of bus routes serving up some of the best state-owned and private operators in the market, offering a range of fleet from which you can choose and do a price compare and check their schedule before closing your online bus ticket booking. Yatra’s smart filters, its range of bus schedule and fleet and a deep-rooted network across the country that connect some of the tier 1 cities with tier 2 and 3 and so on. But more importantly, to make your travel budget friendly, Yatra has a range of on-going bus offers that come with flat discounts as well as eCash redemption offers on your bus booking. Among top reasons to book with Yatra is its inventory of more than 100,000 routes, the availability of road transport buses, attractive discounts and a chance to earn and burn your eCash.

erechargebyte Provide a Comprehensive flight Handling Services to private business jets, corporate air charters, VIP/ Diplomatic charter flights, IFOS has an impressive clientele including State Governments, Charter Management Companies , Medical (Air Ambulance) Operators, Military and Freight Operators. We provide highly competent Comprehensive Flight Handling Services as we are always conscious of the need to ensure timely and efficient service. Our aim is to deliver a quality, seamless experience for our large client base with their variety of aircraft and service requirements. We look forward assisting you in the Future.

The perfect way to get through your everyday travel needs. City taxis are available 24/7 and you can book and travel in an instant. With rides starting from as low as Rs. 6/km, you can choose from a wide range of options! You can also opt to do your bit for the environment with Ola Share! Ride out of town at affordable one-way and round-trip fares with Ola’s intercity travel service. Choose from a range of AC cabs driven by top partners, available in 1 hour or book upto 7 days in advance. We have you covered across India with presence in 90+ cities with over 500 one way routes.

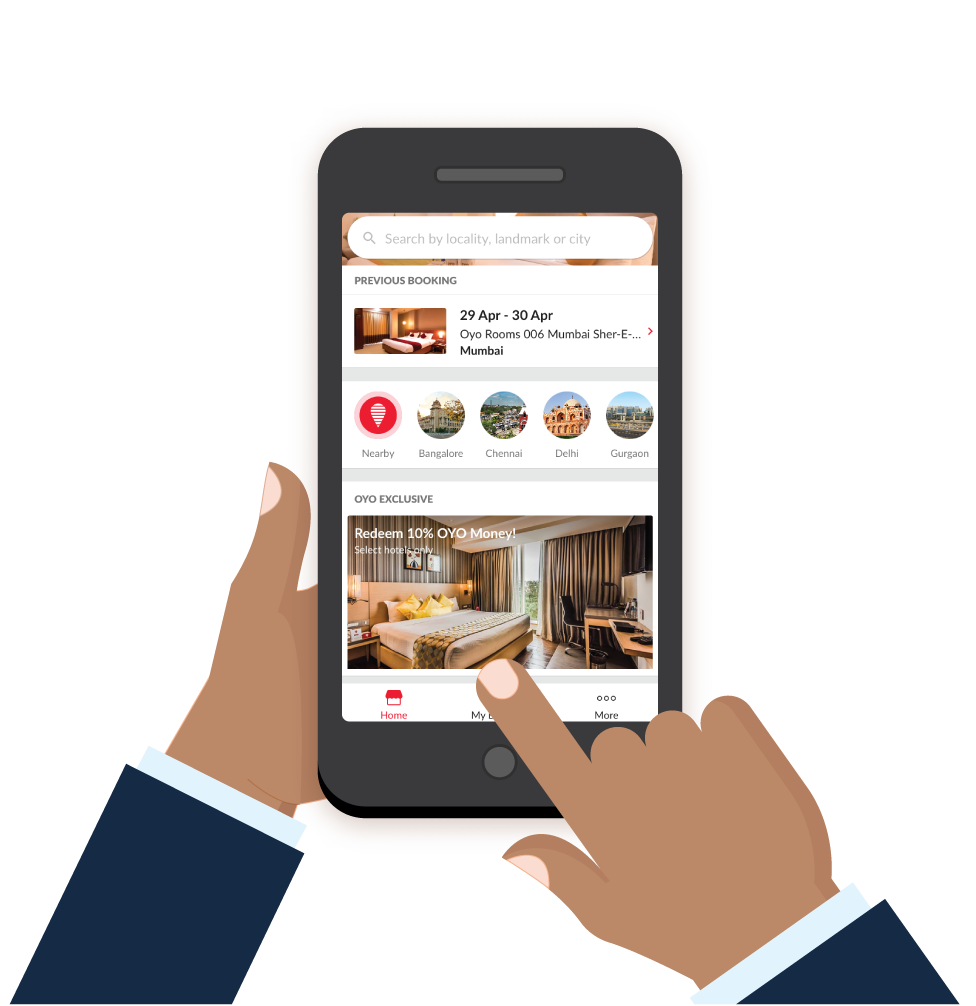

In March 2018, OYO acquired Chennai-based service apartment operator, Novascotia Boutique Homes,[42][43] to establish its presence in the service apartment and corporate executive stay segment. It further acquired Weddingz.in, a Mumbai-based online marketplace for wedding venues and vendors, marking its entry into the fragmented $40-billion wedding industry.[44] In 2019, OYO had over 17,000 employees globally,[17][18] of which approximately 8000 are in India and South Asia. OYO Hotels & Homes is a full-fledged hotel chain that leases and franchises assets. The company invests in capex,[19] hires general managers to oversee operations and customer experience, and generates around a million job opportunities in India[20] and South Asia alone. OYO set up 26 training institutes for hospitality enthusiasts across India in 2019.[21]

Scan & Pay: Pay by scanning the QR code through Scan & Pay or generate your to let others make easy payments to you. Transactions: Check your transaction history and also pending UPI collect requests (if any) You can raise complaint for the declined transactions by clicking on report issue in transactions. Bharat Interface for Money (BHIM) is an app that lets you make simple, easy and quick payment transactions using Unified Payments Interface (UPI). You can make instant bank-to-bank payments and Pay and collect money using just Mobile number or Virtual Payment Address (UPI ID).

erechargebyte, in association with IRCTC allows its retailers to become authorized IRCTC e-ticket agents and book train tickets as per IRCTC guidelines. This service is available 24X7 for the customers. Being an IRCTC e-ticket agent, this service can also be utilised to share information on Train Routes, Train Timings, Train Fare and Seat Availability. Currently erechargebyte has over 7,000 IRCTC agents across India. Booking tickets and providing train information is easier for retailers because we provide them with a user friendly and quick interface.

erechargebyte support travel companies to define their own holiday packages and sell online through B2C and B2B web portals. erechargebyte Back end system encompasses a comprehensive CMS (content management system) for travel agents, home based travel agencies and tour operators that allows users to configure a package including flights, hotels, sightseeing, day activities, terms, policies etc and its visibility preference on websites.

The best way to take payments from your customers. A customer needs his Aadhaar number and his presence at the counter. The Micro-ATM comes with a biometric scanner which enables the authentication. If a customer wants to make payment, then he/she just needs to enter his/her Aadhaar Number in the Micro ATM, scan his/her finger on biometric scanner attached to MicroATM and select the bank from which the payment is to be made. Upon entering the Aadhar Number, the system would automatically fetch the bank account linked with the customer’s Aadhaar number and debit the bank account just like debit card or Bharat QR code. A receipt is printed for each transaction. Just like debit card receipt, Aadhaar number is masked on the receipt with only few digits shown in receipt with balance masked by printing a * for masked digits. Currently the government is incentivizing this category.

PAN Card verification is a mandatory and simple procedure which can be done online. Online PAN Card verification is a provision which is made available for certain government websites and can be done if you have all the details.

NSDL e-Governance Infrastructure Limited has been authorised by the Income Tax Department to provide eligible entities who verify PAN Cards. The e-Governance service provides online verification of PAN cards.

erechargebyte is among the biggest financial services company in the country. They are owned by the Government of India and provides financial technology to the financial sectors of the government. UTIISL like NDSL provides PAN cards for the Indian population who apply from their website.

GST Verification Online Verify GSTIN/UIN Number India, Just type your GSTIN/UIN number below and check name and address of the GSTIN/UIN holder. However due to non updation by Few State vat department ,you may not found latest GSTIN/UIN number details . If you don't found the details of GSTIN/UIN required then you can still check the details on respective state Government page. It is a comprehensive, multistage, destination-based tax: comprehensive because it has subsumed almost all the indirect taxes except a few state taxes. Multi-staged as it is, the GST is imposed at every step in the production process, but is meant to be refunded to all parties in the various stages of production other than the final consumer and as a destination-based tax, it is collected from point of consumption and not point of origin like previous taxes.

Goods and services are divided into five different tax slabs for collection of tax: 0%, 5%, 12%, 18% and 28%. However, petroleum products, alcoholic drinks, and electricity are not taxed under GST and instead are taxed separately by the individual state governments, as per the previous tax system. There is a special rate of 0.25% on rough precious and semi-precious stones and 3% on gold.

A valid Voter ID serves as an identification proof and is also a mandatory document for voting purposes. In this fast-paced world, everything is done online as it saves time. Gone are the days when you have to stand in a long queue to apply for a Voter ID Card or check the status. Nowadays you can check your Voter ID Card details online in just a few seconds.You can now check the status of your voter ID application and also make changes online. Here is a guide on the same.

A voter ID card, also known as ‘Voter Registration Card’ or an ‘Election Card is issued to an Indian citizen by the Election Commission of India.

Thid acts as a proof of your citizenship and allows you to cast your votes in the country.

This photo identity card helps in improving the accuracy of the electoral roll and to help prevent cases of electoral fraud.

In case you have applied for a Driving License (DL), you can check the status of the driving license online. The process to check the status of the license online is simple and can be completed in a few minutes. Instead of waiting for the driving licence to arrive by post, you can visit the respective RTO Offices (Regional Transport Office) with your token number to check your driving licence status.e (RC) is an official document that is issued when someone registers their motor vehicle. It acts as proof that the motor vehicle belongs to a specific person. In India, it is mandatory to register your motor vehicle. If you are caught driving on the road without a valid RC, it is a punishable offence that may result in imprisonment or fine or both. Also, the parents of minors found driving without a valid Learner’s Licence will be punished severely for allowing the act

Unified Payments Interface (UPI) is a system that powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing & merchant payments into one hood. It also caters to the “Peer to Peer” collect request which can be scheduled and paid as per requirement and convenience.

With the above context in mind, NPCI conducted a pilot launch with 21 member banks. The pilot launch was on 11th April 2016 by Dr. Raghuram G Rajan, Governor, RBI at Mumbai. Banks have started to upload their UPI enabled Apps on Google Play store from 25th August, 2016 onwards.

In the world of financial services, account verification is a process that helps businesses verify ownership of bank accounts. This is usually done due to regulatory requirements, in some cases, or to help reduce risk of fraud or costly errors. Many businesses need to charge or send money to customers. To do that, they’ll often need their bank account information. In most cases, businesses have relied on customers to provide their account details. But people can make mistakes – or even try to commit fraud.

Verify if a bank account exists, match name provided by beneficiary with name at bank and minimise the failed or transfer reversals. Know the accurate reason for verification failure.

That’s where account verification comes in: to make sure that the provided account number is not only valid, but also belongs to the person (or business) claiming to own it. This benefits both sides in essentially the same way: by making sure the money will come to – or from – the right place.

IFSC is short for Indian Financial System Code and represents the 11 digit character that you can usually see on your bank’s cheque leaves, or other bank sponsored material. This 11 character code helps identify the individual bank branches that participate in the various online money transfer options like NEFT and RTGS. IFSC is short for Indian Financial System Code and represents the 11 digit character that you can usually see on your bank’s cheque leaves, or other bank sponsored material. This 11 character code helps identify the individual bank branches that participate in the various online money transfer options like NEFT and RTGS.

The operator fetch API use to get precise telecom operator and circle of any mobile number in India. Cyrus has developed which has comprehensive features and functions that is easy to manage, handle and analysis the telecom business. It is used to make online recharge. Beta Source Software Plans API is a comprehensive database. This is generated from direct operator feeds and official operator offers list. We will be listing all the latest recharge plans in this browse plan API. The plans are daily updated and thus we ensure all data is accurate. We support almost 9+ categories where the ML algorithm categories data. Some of these categories include Full Talktime offers, Top up offers, 4G, 3G, data recharge, Special recharges and so on. All the plans available are in TRAI prescribed format.

Bharat Bill Payment System also known as BBPS in short is a kind of unified payment system authorized by the government of India allowing its user to pay all the utility bills under one platform. It’s an interoperable bill payment service to the individuals through agents or business correspondents. PayRupees offers API for BBPS allowing a business correspondent or an agent to offer bill payment solutions to their customers with ease. Our APIs accept payments from multiple modes including net banking, debit cards, credit cards, UPI, etc. Offering utility bill services like water bills, electricity bills, telecom bills, etc. using our BBPS API provides a great commission to the agents. Our BBPS APIs are affordable with the highest commission rates to give good returns on investment in a short span of time.

For the bill payment surety, our BBPS API provides instant confirmation via SMS, emails, or printed receipts. With easy integration and one-point access, we offer assured revenue opportunities with customer footfall.

When you are trying to sell your home, you will want to get the best price that you can for it, and for this reason you always need to make sure that it is in a great condition when people come to view it. One of the things that they might take a look at when getting an idea is your roof, so it is vital that you get in touch with a Fetcham roofer as soon as possible to deal with any issues.

One of the reasons that a poor quality roof might put somebody off buying a home is simply because of the way that it looks. Everybody wants their new home to look nice, and the roof is one of the first things that people will look at.

They will also want to make sure that they aren’t going to run into any expensive problems in the near future. A broken roof will mean that it needs to be repaired soon, and something like this isn’t cheap. So, it is better to fix it in advance.

DTH Customer Info Fetch API provides the customer info for the queried DTH number. Our API provide almost all the information like the customer plan, customer name, customer balance, plan amount and much more. Using Cyrus API, the bill payment provider enable to verify the customer details before processing the request and this process reduce the issue of sending a recharge to a wrong number.

DTH Customer Info provides the customer information for your queried DTH number. The API provides information like the customer name, the client plan, strategy amount, customer balance and so on. Applying this, the invoice payment provider can verify the customer details before processing the petition. This eliminates the dilemma of sending a recharge to the wrong number.

Most of the time, the channels will not get listed as soon as you recharge your Airtel DTH account. It will ask for subscribing to the channel even after successful recharge. If you have recharged your Airtel Set-top-box without turning it on, then you might have noticed that the channels are not being displayed. If it is displaying “Error Code 4” or “Error code 6,” then to restart your account, you must “Refresh” your Airtel DTH account. To get back the channels, give a missed call to 9154052278 (soft refresh) from your registered mobile number, and wait for 1 minute. If the channel is not yet active, then have to opt for a heavy refresh.

Most of the time, we forget to recharge our Airtel Digital TV account, after which the operator deactivates your account. To reactivate the account, we directly recharge the Airtel Digital TV account, but the relevant channels may not be displayed on the TV. So, you have to opt for Box heavy Refresh to activate the channels. Please make sure that your TV and Set-top box is turned on during the process.

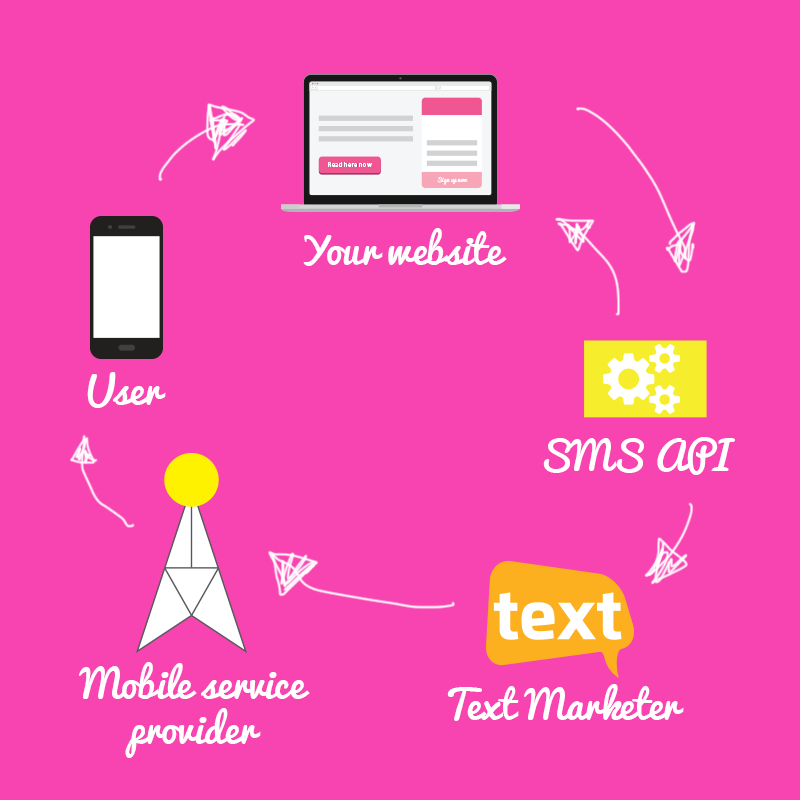

erechargebyte Leading Bulk SMS Service Provider with free Bulk SMS Gateway Developer API provider in India. Use our best restful api for your business connect with software, application, eCommerce website and hardware. free Bulk sms gateway developer api – Send Unlimited SMS via SMS API. we are providing http api, https api, smpp api these all api could be used for both low and high end messaging services. We support various methods of sending and receiving sms.

Easily integrate into your business workflows by using a single unified API. Get access to our own infrastruture with 650 direct operator connections in 190 countries. This provides you low-latency, high-reliability interactions. It’s easy. It’s secure. It’s global.

Redundant connectivity and intelligent routing ensures your message follows the best delivery path with the lowest latency to ensure fast and successful delivery of every message, every time.

Add WhatsApp to your contact center and let your agents easily connect with customers – providing personalized support through multiple chats at the same time. Grab attention and get a reaction. Use rich media and clickable buttons to get more conversions – from survey responses to web visits and notification subscriptions. Integrate WhatsApp Business API into your existing system or get complete access to a world of customer engagement with Infobip Moments, Conversations and Answers. We know that introducing new communication channels isn’t always easy. That’s why our local teams are here to support you with integration and onboarding.

On erechargebyte payment gateway you get the widest range of payment options. We support Credit Card, Debit Card, Net Banking, Paytm and other wallets, UPI via BHIM UPI , Google Pay, PhonePe etc. We also provide multiple bank EMI and cardless EMI options such as Zest Money. With erechargebyte payment gateway you can also give your customers Buy Now Pay Later option by using Ola Money Postpaid, ePayLater etc. Our merchants say that Buy Now Pay Later option has increased checkout success rate by 25-30% for high ticket value transactions. For details, visit the pricing page

erechargebyte is the easiest payment gateway solution for any developer. You can do the integration on any website with any stack. We have Simple Payment APIs with detailed documentation and SDKs for all major platforms. With responsive developer support, integrating erechargebyte is a smooth experience!

Achieving Business rules kind of functionality in portal forms is a bit trickier as Business rules do not directly reflect on the Dynamics 365 Portals.

One of such requirements is to show/hide a field based on other field value dynamically on Dynamics 365 Portals.

In the below scenario, Requirement is to show Other Reason text field if user selects lookup value of “Other” on the portal form for a custom lookup field Called “Reason” on Case entity portal form.

Navigate to Entity Form called “Customer Service – Create Case” and scroll down to custom JavaScript area:

With Dynamic Links, your users get the best available experience for the platform they open your link on. If a user opens a Dynamic Link on iOS or Android, they can be taken directly to the linked content in your native app. If a user opens the same Dynamic Link in a desktop browser, they can be taken to the equivalent content on your website. In addition, Dynamic Links work across app installs: if a user opens a Dynamic Link on iOS or Android and doesn't have your app installed, the user can be prompted to install it; then, after installation, your app starts and can access the link.

A product detail page (PDP) is a web page on an eCommerce site that presents the description of a specific product in view. The details displayed often include size, color, price, shipping information, reviews, and other relevant information customers may want to know before making a purchase. Typically, this information is presented alongside an actual photo of the item, as well as an “add to cart” button. The product detail page is a crucial element to your eCommerce strategy because it is where the fate of a potential sale lives. The product detail page should be carefully designed so that a hierarchy of information is presented in an intuitive manner. This page has the potential to optimize the consumer experience by presenting product details the way your target consumer wishes to view content on your site. This means establishing a healthy balance between too much information and just the right amount of detail to sway buyers’ interest in completing a purchase.

erechargebyte is a zero balance digital bank account available to everyone (Resident Indian individuals only). erechargebyte lets you choose between a zero balance account or an erechargebyte savings account based on your needs, which acts as a one stop solution for all your financial needs and day to-day transactions. The erechargebyte account helps you save as well as grow your money with its varied investment offerings. The account also lets you transfer funds, pay bills and do more easily.

Minimum Balance: No charges or fine on non-maintenance of minimum balance. Now, spend your balance to the last rupee without any worry.

Virtual Debit Card: Get a Virtual Debit Card instantly for online shopping

erechargebyte is a specialist technology company that focuses on the new and exciting area of QR Code Payments and QR Codes. erechargebyte offers a range of QR Code related products including erechargebyte (erechargebytement App), erechargebyte (QR Code Payments), QR Track (QR Code Tracking) and QR API.

erechargebyte offers a mobile QR Code Payment processing solution that enables individuals and businesses to make and receive payments with QR Codes via the erechargebyte or erechargebyte apps. erechargebyte also offers QR Code payments by SMS/Text opening up the service to all mobile phone users.

erechargebyte is a QR Code Payment App which enables users to Scan, Store and Share their QR Code and Barcode scans. erechargebyte includes erechargebyte's new contactless payment solution that enables individuals and businesses to make payments via QR Codes and mobile phones. Other features include SafeScan (protecting users from malicious codes), product comparison (barcodes), online backups and synchronisation.

I am thinking of using a QR code to login to a website. This way a user doesn't have to enter a user id/password.

users goes to a website.

the website need autorisation.

the website present a QR code.

the user scans the QR code with his/her phone.

Somehow the originating website gets confirmation that the QR code was scanned by a known phone.

Somehow the originating website gets confirmation that the QR code was scanned by a known phone.

Now the website knows the user and the user is logged in. This is safe because the phone is known to the site. If needed the user can protect the phone with a PIN code or other locking system.

On erechargebyte payment gateway you get the widest range of payment options. We support Credit Card, Debit Card, Net Banking, Paytm and other wallets, UPI via BHIM UPI , Google Pay, PhonePe etc. We also provide multiple bank EMI and cardless EMI options such as Zest Money. With erechargebyte payment gateway you can also give your customers Buy Now Pay Later option by using Ola Money Postpaid, ePayLater etc. Our merchants say that Buy Now Pay Later option has increased checkout success rate by 25-30% for high ticket value transactions. For details, visit the pricing page

erechargebyte is the easiest payment gateway solution for any developer. You can do the integration on any website with any stack. We have Simple Payment APIs with detailed documentation and SDKs for all major platforms. With responsive developer support, integrating erechargebyte is a smooth experience!

On erechargebyte payment gateway you get the widest range of payment options. We support Credit Card, Debit Card, Net Banking, Paytm and other wallets, UPI via BHIM UPI , Google Pay, PhonePe etc. We also provide multiple bank EMI and cardless EMI options such as Zest Money. With erechargebyte payment gateway you can also give your customers Buy Now Pay Later option by using Ola Money Postpaid, ePayLater etc. Our merchants say that Buy Now Pay Later option has increased checkout success rate by 25-30% for high ticket value transactions. For details, visit the pricing page

erechargebyte is the easiest payment gateway solution for any developer. You can do the integration on any website with any stack. We have Simple Payment APIs with detailed documentation and SDKs for all major platforms. With responsive developer support, integrating erechargebyte is a smooth experience!

Seamlessly transform timely e-commerce for diverse leadership skills. Conveniently reconceptualize go forward expertise without extensible applications. Phosfluorescently.